accumulated earnings tax calculation

The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. This figure is calculated as EP at the beginning of the year plus current.

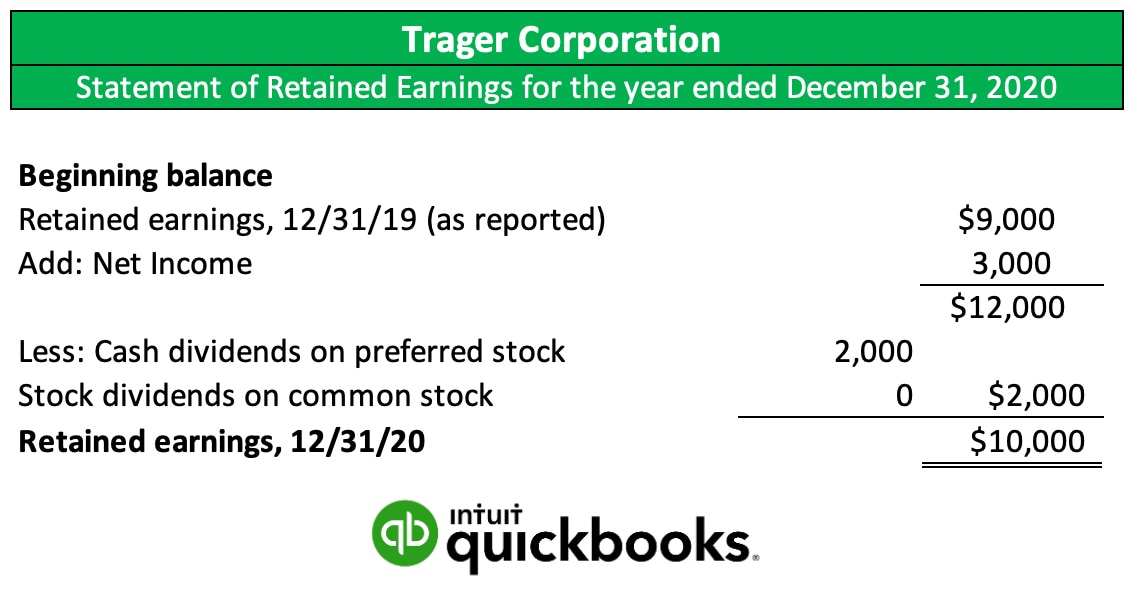

What Are Retained Earnings Quickbooks Canada

The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its.

. For example lets assume a certain. Net Income After Taxes Niat The calculation of accumulated retained. When the PHC tax applies there is relief from the accumulated earnings tax Section 532 a b 1.

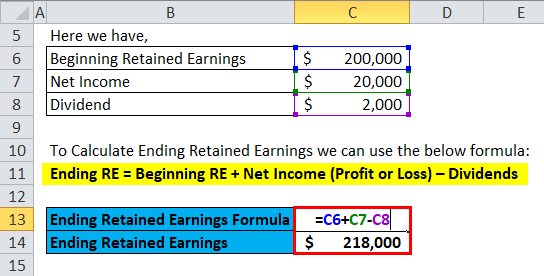

Calculation of Accumulated Earnings The formula for computing retained earnings RE is. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. Using the Bardahl formula X estimated it will cost 25 cash to complete an.

The regular corporate income tax. Bardahl Formula Calculator - Refute IRS Accumulated Earnings Assertions Use the Bardahl Formula Calculator to avoid and defend against Accumulated Earnings Tax. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

At any time during the last half of the tax year more than 50 of the value of its outstanding stock is directly or indirectly owned by or for five or fewer individuals. Accumulated Earnings Tax Accumulated Taxable Income 20 Personal Holding Company Tax In times past the tax rate on individuals was considerably higher than. A corporation determines this amount by adjusting its taxable income for economic items to.

For example suppose a certain company. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and. Corporation has a book net income of 20 million 500000 of book depreciation 1 million of tax depreciation 500000 of earnings and profits.

The base for the accumulated earnings penalty is accumulated taxable income. Calculating the Accumulated Earnings The formula for calculating retained earnings RE is. Suppose that a US.

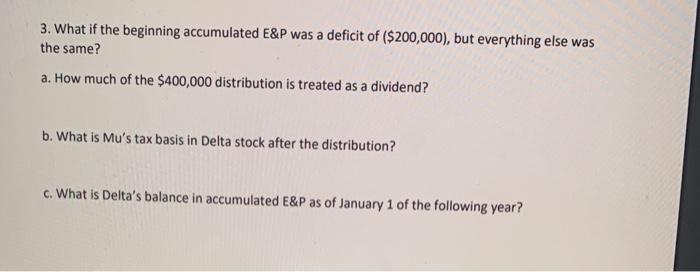

Accumulated earnings and profits EP are net profits a company has available after paying dividends. The accumulated earnings tax will take effect if a firm decides to keep its profits or earnings instead of distributing dividends to shareholders and the amount of retained earnings. Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable.

RE initial retained earning dividends on net profits. The tax is assessed at the highest individual tax rate. The tax rate on accumulated earnings is 20 the maximum rate at which they.

The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. Given the reasonable needs of the. RE Initial RE net income dividends.

The PHC tax is self-imposed. At the end of year 1 it had 100 of accumulated earnings 40 of which will be paid as a dividend.

Retained Earnings Formula Calculator Excel Template

What Is A Statement Of Retained Earnings Bdc Ca

Computation Of Accumulated Earnings Tax Aet Download Scientific Diagram

Accumulated Deficit Formula And Calculator

Demystifying Irc Section 965 Math The Cpa Journal

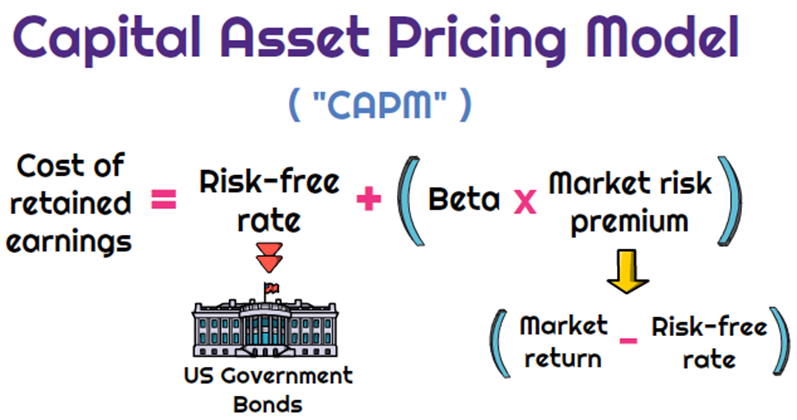

Methods To Calculating The Cost Of Retained Earnings Or Common Equity Universal Cpa Review

Solved Calculate The Current Earnings And Profits E P Of Chegg Com

Schedule L Balance Sheets Per Books For Form 1120 S White Coat Investor

Determining The Taxability Of S Corporation Distributions Part I

1120 Ef Message 0042 Schedule M 2 Is Out Of Balance

Income Tax Formula Excel University

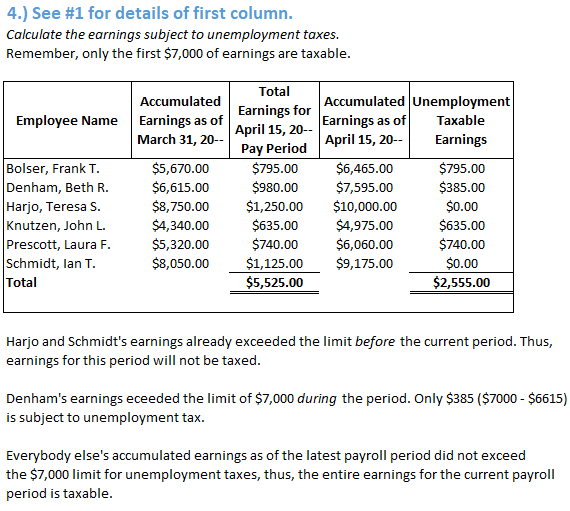

Use Malone S Selected Payroll Information For The Two Semimo Quizlet

Retained Earnings Re Financial Edge

Determining The Taxability Of S Corporation Distributions Part Ii

/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

Retained Earnings In Accounting And What They Can Tell You

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Payroll Deductions Cont 110 Terms You Will Use Accumulated Earnings Employee S Earnings Record Employee S Withholding Allowance Certificate Federal Income Ppt Download

/GettyImages-185121887-3537e49a2e394fe5927d3cfb1dd0a8fb.jpg)

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)